You identify an uptrend.

You go long.

The trend reverses — and you get stopped out.

Then you start wondering…

“Is the trend really my friend? If so, why do I keep getting stopped out?”

Here’s why:

A new trader looks for a trend and enters a trade. But…

A seasoned trend trader looks for a specific type of trend, stalks the best entry, let the market comes to him — and then enters a trade.

Now if you want to trade trends like a pro, then this trend trading strategy guide is for you.

The benefits of trend trading strategy

You’ll love it because it:

- Improves your win rate

- Offers a better risk to reward

- Can be applied across any markets

Let me explain…

Trend trading improves your win rate

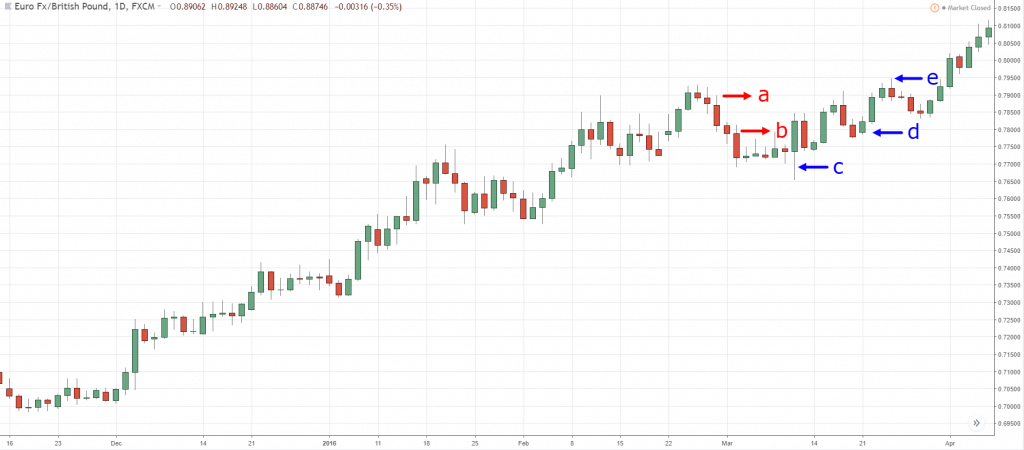

There are 5 points in this chart: A, B, C, D, and E.

Now ask yourself…

Do you want to buy at C, D or E?

Or go short at A or B?

Chances are, you’ll prefer C, D or E because the move last longer and you have a higher probability of winning.

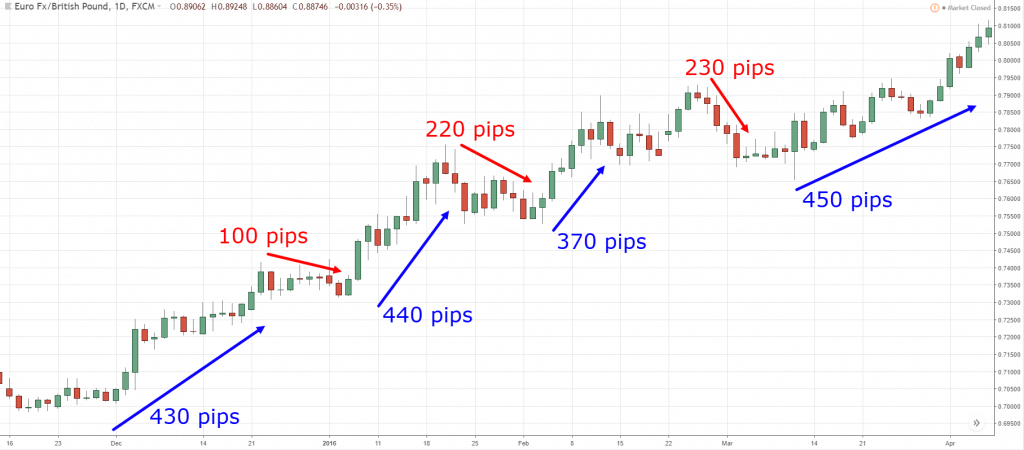

Offers a better risk to reward

Besides increasing your win rate, trend trading also improves your risk to reward.

Here’s what I mean:

This means for every $1 you risk, you could make a multiple of that amount (like $2, $3, or even $10).

Trend trading can be applied across any markets

Here’s the thing:

Trends exist due to greed and fear in the markets.

When there’s greed, you’ll get more buying pressure, which results in higher prices (an uptrend).

When there’s fear, you’ll get more selling pressure, which results in lower prices (a downtrend).

You’re probably wondering:

“Will trend trading stop working?”

Only if humans have no emotion (which is unlikely).

Thus, you can expect trends to occur in any markets like forex, futures, stocks, bonds, agriculture, etc.

30-Year Treasury Bond:

USD/JPY:

Fun facts:

Jesse Livermore, the most famous trader of all time, made $100 million in 1929.

Richard Dennis, the founder of the turtle traders, made $400 million trading the futures market.

Ed Seykota, possibly the best trader of our time, achieved a return of 250,000%, over a 16 year period.

Do you know what they have in common?

They adopt a trend trading strategy.

How to define trends like a pro

You probably know…

An uptrend consists of higher highs and lows. And downtrend consists of lower highs and lows, right?

But… what if you get a chart that looks like this?

Is this an uptrend, range, or downtrend?

Uh oh.

And this is the problem when you define trends using higher highs and lows — there is subjectivity involved.

So, what can you do?

You can use the 200-period moving average (MA) to help you with it.

Here’s how…

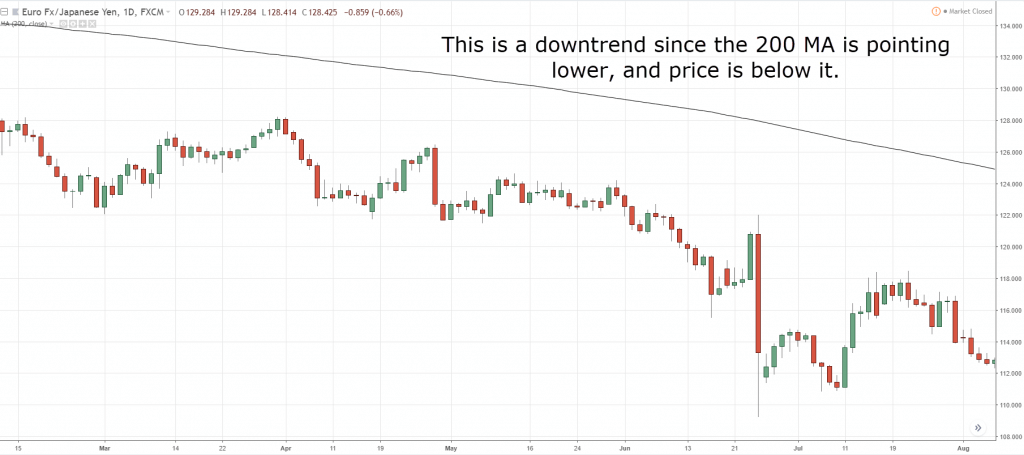

If the price is above 200MA and 200MA is pointing higher, then it’s a long-term uptrend.

If the price is below 200MA and 200MA is pointing lower, then it’s a long-term downtrend.

An example:

Now, the next thing you must know is…

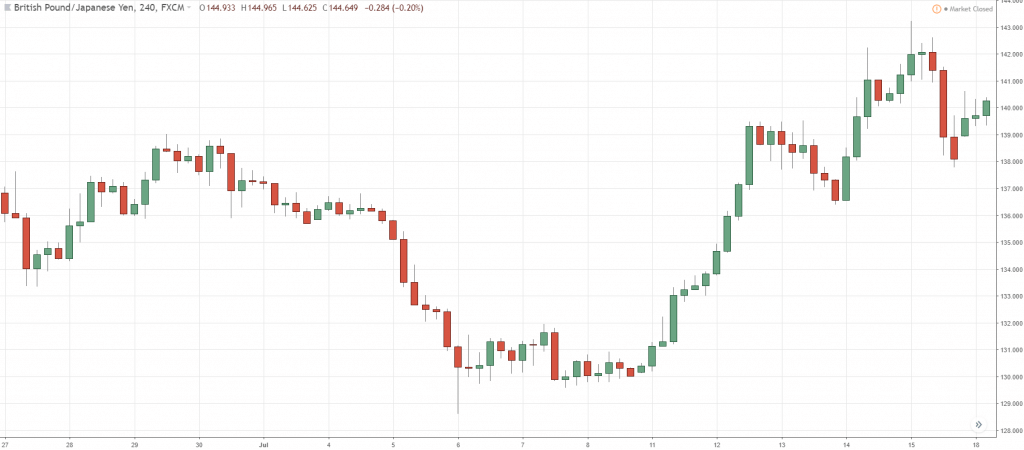

Trends can exist on different timeframes

Here’s the thing:

Depending on the timeframe you’re on, a market can have different trends on different timeframes.

Here’s what I mean…

Downtrend on weekly:

Uptrend on 4-hour:

Now…

A mistake traders make is trading trends on every timeframe. This is a big NO.

Instead, you should trade trends on your selected timeframe.

This means:

If you’re trading the Daily, then your job is to trade trends on the daily timeframe.

If you’re trading the hourly, then your job is to trade trends on the hourly timeframe.

If you’re trading the 5 minutes, then your job is to trade trends on the 5 minutes timeframe.

Get it?

Now to take things a step further…

You can combine trend trading and multiple timeframe analysis to improve your trading results.

3 types of trends every serious trader must know

Most traders assume a trend simply consists of higher highs and lows. But it’s not enough because trends are not created equal. Some are better to trade breakouts, and some to trade pullbacks.

So in this section, you will learn the 3 types of trends (that most traders are unaware of), and the best way to trade each of them.

They are:

- Strong trend

- Healthy trend

- Weak trend

Strong trend – In this type of trend, the buyers are in control with little selling pressure. You can expect this type of trend to have shallow pullbacks —barely retracing beyond the 20MA. In some cases, you will get no selling pressure as the trend goes parabolic.

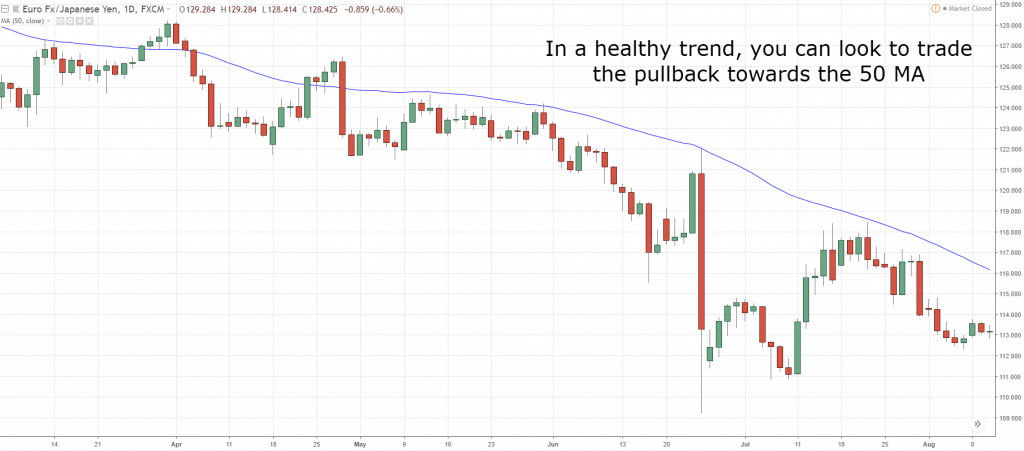

Healthy trend – In this type of trend, the buyers are still in control with the presence of selling pressure (possibly due to traders taking profits, or traders looking to take counter-trend setups). You can expect this type of trend to have a decent retracement usually towards the 50MA, which provides an opportunity to hop on board the trend.

Weak trend – In this type of trend, both buyers and sellers are vying for control, with the buyers having a slight advantage. You can expect the market to have steep pullbacks and tends to trade beyond the 50MA.

When is the best time to enter a trend

Here’s a fact:

There are two ways to enter a trend, on a breakout or pullback. And the entry method you’re going to use depends on the type of trend the market is in.

Let me explain…

Strong trend

In a strong trend, the market has shallow retracement (not exceeding 20MA) which make it difficult to enter on a pullback because the market hardly retraces and then continues pushing higher.

Thus the best way to trade this type of trend is on a breakout or, to find an entry on the lower timeframe.

An example:

Healthy trend

In a healthy trend, the market has a decent retracement which makes it ideal to enter on a pullback.

However, you can also enter on a breakout. But you’ll have to “endure” the retracement back towards 50MA (which drains your mental capital).

Thus, a better entry is to enter on a pullback.

Here’s what I mean:

Weak trend

In a weak trend, the market has steep retracement (usually exceeding 50MA) and it’s difficult to “predict” where the retracement will end using MA.

Also:

In a weak uptrend, the market tends to break the highs only to retrace back much lower (which makes trading breakout difficult).

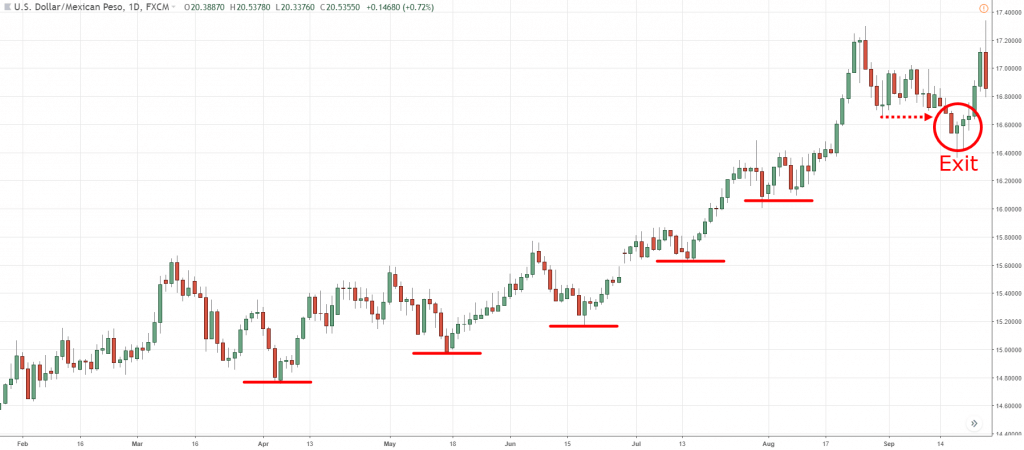

Thus, the best way to enter this type of trend is at Support and Resistance.

An example:

How to set your stop loss in a trending market

Whenever I put on a stop loss, I would think of this quote…

Place your stops at a point that, if reached, will reasonably indicate that the trade is wrong. Not at a point determined primarily by the maximum dollar amount you are willing to lose – Bruce Kovner

So, here are 3 ways you can do it:

- Moving average

- Structure

- Trendline

Let me explain…

Moving average

The key here is to use the MA that is respected by the markets.

For example:

In a strong trending market, price tends to respect the 20MA. Thus, you should place your stop loss below the 20MA. And if it breaks, you know your trading idea is wrong.

Or…

If price tends to respect the 50MA, then place your stop loss beyond 50MA.

Structure

Here’s the thing…

An uptrend consists of higher highs (and lows), and a downtrend consists of lower highs (and lows).

So, here’s what you can do:

Uptrend — you can place your stop loss below the previous low

Downtrend — you can place your stop loss above the previous high

An example:

Trendline

Here’s a two-step process in using trendline:

- Draw trendlines by connecting the lows of an uptrend (and highs of a downtrend).

- Once you’ve identified the “barrier”, you can set your stop loss below the trendline (for uptrends), and above the trendline (for downtrends).

Here’s what I mean:

Now you’re probably wondering:

“Where exactly do I set my stop loss?”

Now…

You don’t want to set your stops at the edge of the trendline (or structure) because you could get stopped out prematurely. Likewise, you don’t want to place it too far away, which hurts your risk to reward.

Thus, you can set your stop loss 1 or 2 ATR away from the structure which gives your trade enough “room to breathe”.

How to develop a trend trading strategy

Let’s be clear:

A trend trading strategy is only 1/3 of the equation. Without proper risk management and discipline, even the best trading strategy isn’t going to make you money in the long run.

Now…

Whenever I develop a trend trading strategy, it needs to answer these 7 questions:

- Which markets you trading

- What’s the timeframe you’re trading

- What are the conditions of your trading setup

- What is your entry trigger

- Where is your stop loss

- How will you exit your winners

- How will you manage your trade

Markets Traded

- Agriculture commodities

- Currencies

- Equities

- Rates

- Non-Agriculture Commodities

Trend trading strategy template

If the market (on the Daily timeframe) is a healthy trend, then wait for it to pullback towards 50MA.

If the market pullback towards 50MA, then wait for a candle to close in your favor

If the candle closes in your favor, then look to enter on next candle

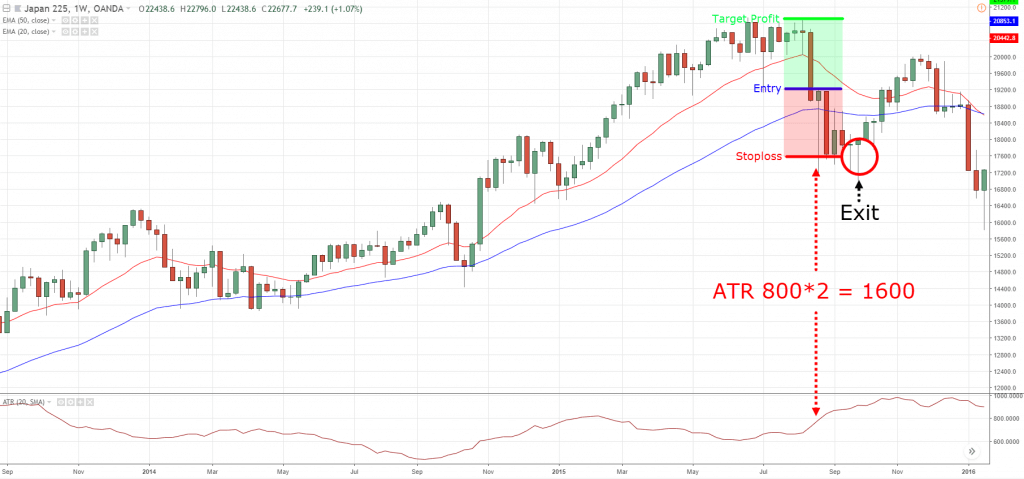

If you enter on next candle, then set your stop loss 2 ATR from entry

If stop loss is set, then look to take profit at the nearest swing high/low

**Disclaimer: I will not be responsible for any profit or loss resulting from using these trading strategies. Past performance is not an indication of future performance. Please do your own due diligence before risking your hard earned money.

Losing trade at (JP225USD):

Winning trade at (EUR/NZD):

Winning trade at (NZD/CAD):

Frequently asked questions

#1: I’m confused when you say trend trading increases your win-rate. Wouldn’t trend trading decrease your win-rate because most markets tend not to trend most of the time?

There’s a difference between trend trading and trend following.

Trend trading simply means trading with the trend. You can be a swing trader in a trending market. Whereas for trend following, you’re attempting to capture the full trend by trailing your stop loss.

So yes, trend trading increases your win-rate as you’re trading along the path of least resistance, compared to someone trading against the trend. However, don’t confuse that with trend following, which is an attempt to ride the entire trend.

#2: If the price is below the 200 MA in the lower timeframe but above the 200 MA in the higher timeframe, should we treat this market as an uptrend or a downtrend?

You should always pay attention to the trend of the timeframe you’re trading on:

If you’re trading on the 5-minute timeframe and it’s in a downtrend, then you should say the market is in a downtrend.

If you’re trading on the daily timeframe, then you should pay attention to the trend on the daily timeframe.

If the timeframes are too far apart, then it’s irrelevant. Because it doesn’t make sense to be following the trend on the daily timeframe if you’re trading on the 5-minute timeframe.

At most, you can take into consideration the trend one timeframe higher than what you’re trading. For example, if you trade on the daily timeframe, you can consider the trend on the weekly timeframe to make sure the trend aligns.

#3: How can I know if it’s going to be just a pullback or a reversal altogether?

On a pullback, the range of the candles is relatively small.

Whereas on a reversal, the range of the candles gets larger and the price tends to break key market structures, like previous swing lows or area of support.

Also, if the price forms a series of lower highs and lower lows, then chances are, the market will enter a range or reverse altogether.

A quick recap of what you have learned

- Trend trading increases your win rate, improves your risk to reward, and can be applied across all markets

- You can define the long-term trend using the 200-period moving average

- In a strong trend, it’s ideal to enter your trades on a breakout (or on a lower timeframe)

- In a healthy trend, it’s ideal to enter your trades on a pullback (towards the moving average)

- In a weak trend, it’s ideal to enter your trades at Support or Resistance

- In a trending market, you can set your stop loss using moving average, trendline, or structure

Now here’s what I like to know…

Do you follow a trend trading strategy? What’s your experience with it?

Leave a comment below and let me know.